Staring at a sticker price that keeps you up at night? You’re not alone. Yet 75 % of new-car buyers say their last purchase was the smoothest ever, thanks to smarter digital tools. This 2025 Online Car-Buying Playbook shows you how to turn those same tools into real dollars off the lot price. In a few minutes, you’ll learn:

What We'll Cover

- What’s changed in 2025’s market (spoiler: inventory is finally back).

- A four-step, data-first price-discovery system.

- How Autoweb, Cars.com, and TrueCar stack up—and when to use each.

- Insider tactics to avoid fees and squeeze out last-mile savings.

Whether you’re hunting a new EV or a certified-pre-owned sedan, this playbook will help you lock a dealership-level deal from your laptop.

Why 2025 Is (Finally) a Buyer’s Year

- Inventory bounce-back. National new-car inventory jumped 36 % year-over-year, easing the shortages that inflated prices in 2022-23.

- Prices leveling. Analysts forecast stable MSRPs through Q4 2025, with compact models under $30 k returning to showrooms.

- Digital comfort zone. Shoppers now visit an average of four websites and complete more than half of the purchase steps online.

- Rate pressure. 55 % of would-be buyers still hesitate because of high APRs—meaning dealers are sweetening incentives to move metal.

Takeaway: More cars + softer demand = leverage for you, especially if you walk in with verified online price data.

The Four-Step Price-Discovery Blueprint

| Step | What to Do | Why It Works |

|---|---|---|

| 1. Benchmark the Market | Plug your exact make/trim into TrueCar’s “Market Average” graph and save the PDF. | Sellers know you’ve seen real transaction data. |

| 2. Layer Incentives | Check OEM rebates on the automaker site, then confirm on Cars.com’s incentives feed. | Rebates come off after negotiating price. |

| 3. Secure an OTD Quote | Ask for an “out-the-door” email quote—tax, title, doc fee— from at least three local dealers. | Forces hidden add-ons into daylight. |

| 4. Trigger the Match | Forward the lowest OTD to competing dealers with a 24-hour deadline. | Creates a bidding war without leaving home. |

Follow the sequence twice—once for purchase price, once for financing—so the F&I office can’t claw back your savings. (Need help comparing APRs? See our car financing options guide.)

Marketplace Showdown: Autoweb vs. Cars.com vs. TrueCar

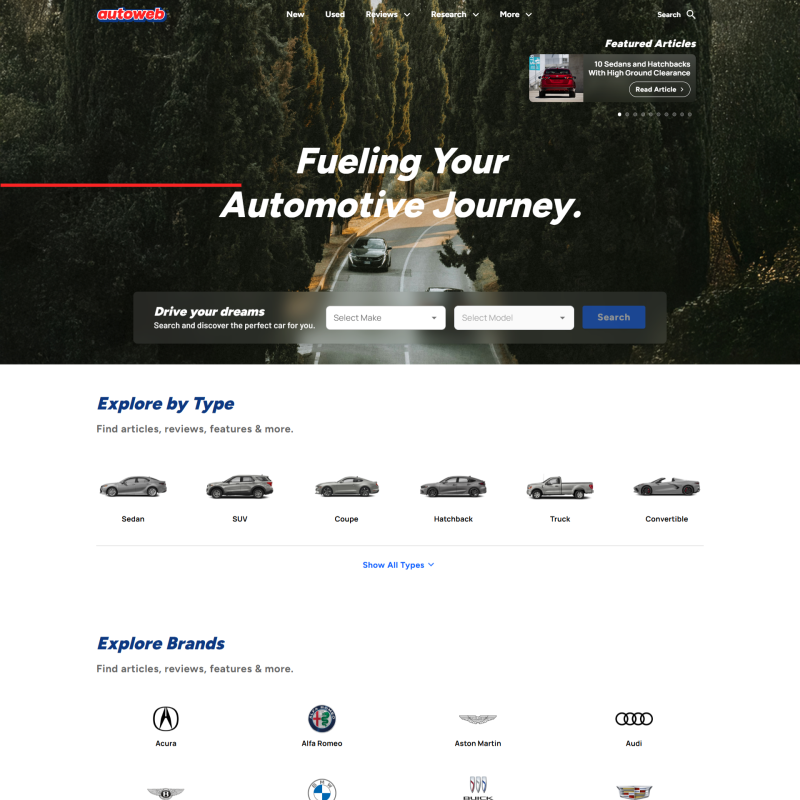

Autoweb.com

Autoweb is one of the original lead-generation platforms (online since 1995) that matches shoppers with local dealers rather than letting you buy entirely online. Its strength is volume: millions of site visits feed a steady stream of high-intent leads to dealerships, which can translate into fast callbacks and aggressive first offers. However, you must submit contact details to see real numbers, and price transparency stops once the dealer takes over. Best for first-time or time-pressed buyers who want the dealer to do the leg-work.

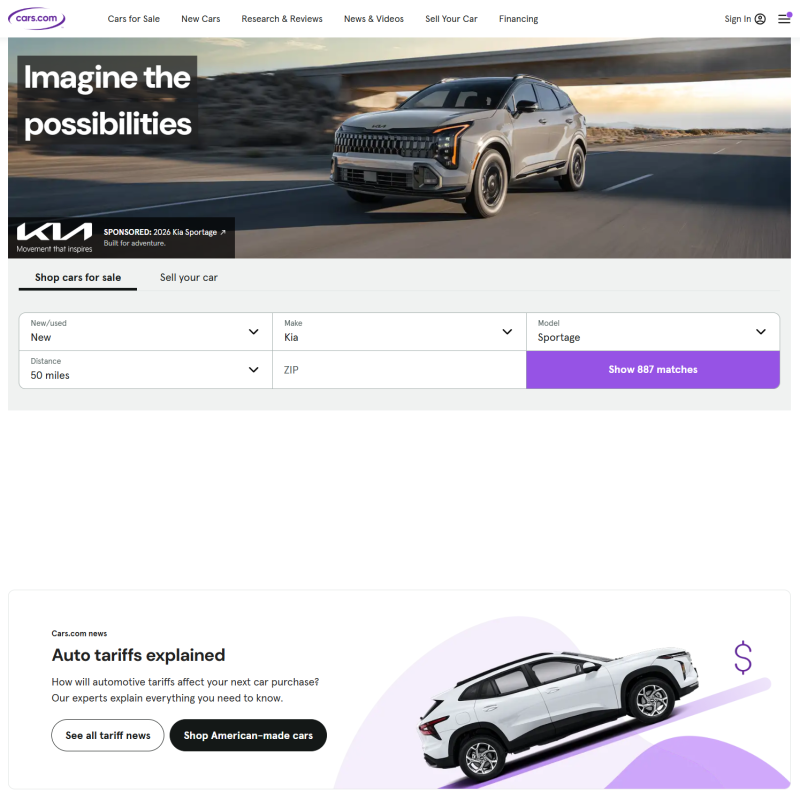

Cars.com

Cars.com behaves like a massive classified marketplace: roughly 35 million visits a month browse more than two million new- and used-car listings. Detailed filters, professional reviews, and an incentives feed make side-by-side research simple, while dealer ratings add accountability. Because listings come directly from dealers, advertised prices can be firm, and you’ll still negotiate the out-the-door figure offline. Ideal for comparison shoppers who enjoy doing their own homework before contacting sellers.

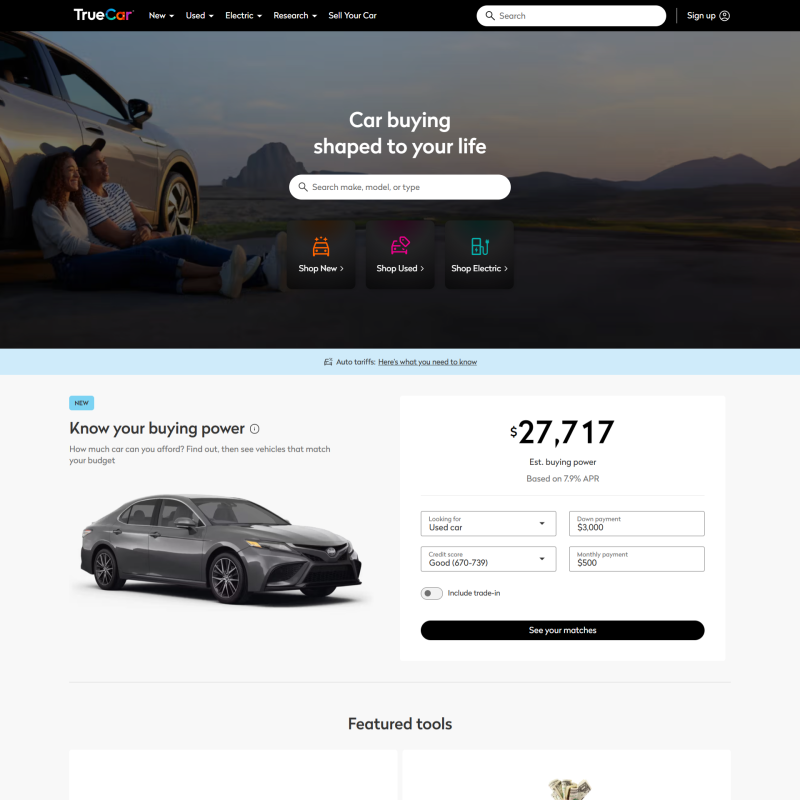

TrueCar.com

TrueCar’s calling card is price transparency. Its “Market Average” tool shows what people actually paid for the exact VIN you’re eyeing, and certified-network dealers agree to honor those pre-negotiated figures—recent internal stats show average savings of about $2 k off MSRP nationwide. The flip side is coverage: if a dealer isn’t in TrueCar’s network, you won’t see its inventory. A great fit for data-driven buyers who want upfront pricing and minimal haggling.

| Feature | Autoweb | Cars.com | TrueCar |

|---|---|---|---|

| Monthly Audience | 42 M shoppers; 4 M leads/year; 69 % first-time buyers | 25 M in-market consumers/month | 12 M+ users; nationwide certified-dealer network (internal data) |

| Listings Size | Aggregates partner sites; strong for used under $15 k | 2 M+ new & used listings | Dealer-verified in-stock VINs |

| Price Tool | Lead-gen request triggers dealer discounts | Real-time incentive & inventory filters | “Market Average” plus build-your-deal online |

| Typical Savings* | Up to 10 % close-rate deals (dealer reported) | Depends on dealer competition | Avg. $2,187 off MSRP Jan-Jun 2024 |

| Best For | First-time buyers wanting callbacks | DIY researchers comparing trims | Data-driven shoppers ready to lock a price |

Advanced Tactics to Stretch Your Deal

Time the Calendar

End-of-quarter Fridays still rule, but inventory-rich 2025 means mid-month can work if you target models lingering 60+ days on Cars.com.

Pre-Appraise Your Trade

Pull free valuations from both TrueCar and Autoweb; present the higher figure when negotiating. Dealers dislike losing easy profit and will often match.

Finance Like a Cash Buyer

Secure a pre-approval from an online credit union before walking in. According to Cox Automotive, mostly-digital buyers spend 49 % less time in F&I and report higher trust in the final price.

Watch the Fee Stack

Dealers can’t waive government fees, but doc fees over your state’s average (check DMV site) are pure profit. Question every line item—window etching, nitrogen tires, paint sealant.

Pitfalls to Dodge in 2025

- Monthly-payment focus. Stretching to 84-month loans hides true cost; stay under 60 months if possible.

- Dealer-added ‘protection packages.’ Most duplicate factory warranties.

- Ignoring EV incentives. Federal and state credits can shave $7,500+ off, but must be claimed at point of sale in 2025 .

Conclusion

The 2025 Online Car-Buying Playbook is simple: use transparent marketplaces to uncover the real price, leverage competing quotes, and walk in armed with data the dealer can’t ignore. Follow the blueprint and you’ll join the growing number of buyers who saved an average of $2,000-plus without haggling.

Next step: Open two tabs—TrueCar for benchmark pricing and Cars.com for live incentives—then request your first out-the-door quote. By this weekend, you could be signing papers on a deal that’s every bit as strong as a pro negotiator’s. Happy driving!

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

Interesting, for buying a new car and comparing different platforms

Awesome timing for this post! Really needed a guide like this. The step-by-step plan and the comparison of the sites are super helpful for actually saving money. Thanks!