Life can be unpredictable, and while we strive to create a stable future for our loved ones, unexpected events can change everything in the blink of an eye. That’s where life insurance comes in. It’s one of the most critical steps you can take to ensure your family is protected financially if something happens to you.

In this guide, we’ll explore the fundamentals of life insurance, examine why it’s essential, and walk you through the process of choosing the right policy. By the end of this article, you’ll gain a clear insight into how life insurance can safeguard your family’s future—and why it’s worth considering sooner rather than later.

What We'll Cover

- What Is Life Insurance?

- Top Life Insurance Companies in the USA

- SelectQuote Term Life Insurance – Expert-Brokered Policy Comparisons

- Best Money Life Insurance

- MassMutual

- Gerber Life Insurance

- Prudential Financial

- Northwestern Mutual

- Why You Need Life Insurance

- Financial Security for Your Family

- Covering Debts, Mortgages, and Final Expenses

- Peace of Mind for Unforeseen Events

- How Life Insurance Works

- How to Choose the Right Life Insurance Policy

- Common Myths About Life Insurance

- A Closer Look at Costs

- Life Insurance for Different Life Stages

- FAQs About Life Insurance

- Final Thoughts

What Is Life Insurance?

Life insurance functions as a contract between you, the policyholder, and an insurance provider. By paying regular premiums, you secure an agreement that if you pass away during the policy’s term, a death benefit will be paid out to the beneficiaries you designate. This lump sum can alleviate financial burdens by covering daily expenses, mortgages, outstanding debts, or even future education costs, thereby offering crucial financial support to the people who rely on you.

Types of Life Insurance

- Term Life Insurance: Provides coverage for a specified period, typically 10, 20, or 30 years. If you pass away during that timeframe, your beneficiaries receive the death benefit. These term policies are generally more budget-friendly, though they do not build any cash value.

- Whole Life Insurance: Provides coverage for the entirety of your life and includes a cash value component that steadily grows over time. Although its premiums are generally higher than those for term policies, they stay the same throughout the duration of your coverage.

- Universal Life Insurance: Similar to whole life, but it offers more flexibility in premium payments and the death benefit. You can adjust your coverage or premiums as your financial situation changes.

- Variable Life Insurance: Allows you to invest part of your premium in various investment options like stocks or bonds. This can increase (or decrease) the cash value based on market performance.

Key Features and Benefits

- Guaranteed Payout: Provides financial assistance to your loved ones when they need it most.

- Fixed Premiums or Flexible Payments: Depending on the type of policy, you can choose a plan that suits your budget and lifestyle.

- Cash Value Growth: Whole, universal, and variable policies can build cash value over time, acting as a long-term savings or investment vehicle.

Top Life Insurance Companies in the USA

Below is a snapshot of several reputable life insurance providers, highlighting their key features and what sets them apart.

SelectQuote Term Life Insurance – Expert-Brokered Policy Comparisons

SelectQuote Term Life Insurance connects consumers with a variety of term life insurance policies from top-rated carriers. As an independent brokerage, their service focuses on personalized policy comparisons facilitated by licensed agents, who help you identify coverage amounts (ranging from $100,000 to several million) and term lengths (10–30 years) that align with your financial goals. The platform streamlines the process of securing affordable, customizable term life insurance, with some policies requiring no medical exams.

- Key Strength: Access to experienced agents who provide tailored recommendations and simplify comparisons across multiple insurers.

- Ideal For: Individuals seeking hands-on guidance to navigate term life insurance options, particularly those who value expert advice and want to avoid the hassle of contacting insurers individually.

Best Money Life Insurance

Best Money Life Insurance connects consumers with a range of life insurance options tailored to diverse needs. Their platform offers easy-to-compare quotes, helping you find policies with straightforward application processes and competitive rates.

- Key Strength: A user-friendly comparison tool for quick and accurate quotes.

- Ideal For: Anyone wanting to explore multiple insurers in one place.

Here’s a concise, structured review of SelectQuote Term Life Insurance, modeled after your example for Best Money Life Insurance:

MassMutual

Founded in 1851, MassMutual stands out for its extensive history and focus on helping families plan for the long term. They offer various life insurance options, including whole and term policies, along with robust advisory services.

- Key Strength: Long-standing reputation with in-depth financial planning resources.

- Ideal For: Families seeking guidance on comprehensive financial strategies.

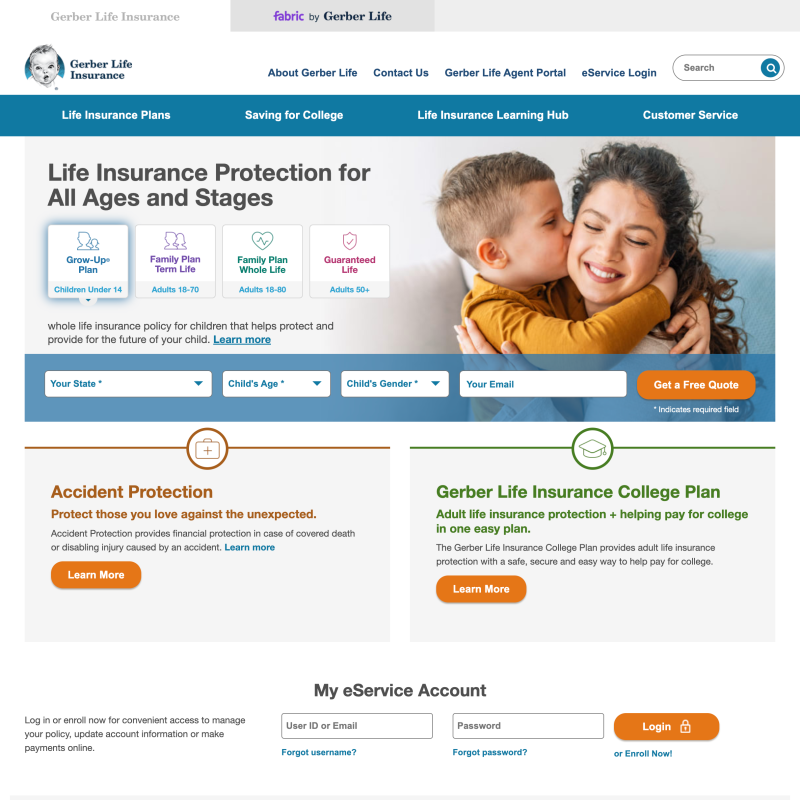

Gerber Life Insurance

Gerber Life is known for affordable, family-friendly policies, including plans specifically designed for children. They make it straightforward to set up coverage for your little ones, offering peace of mind as your family grows.

- Key Strength: Child-focused policies and affordability.

- Ideal For: Parents looking for simple solutions to secure coverage for their children.

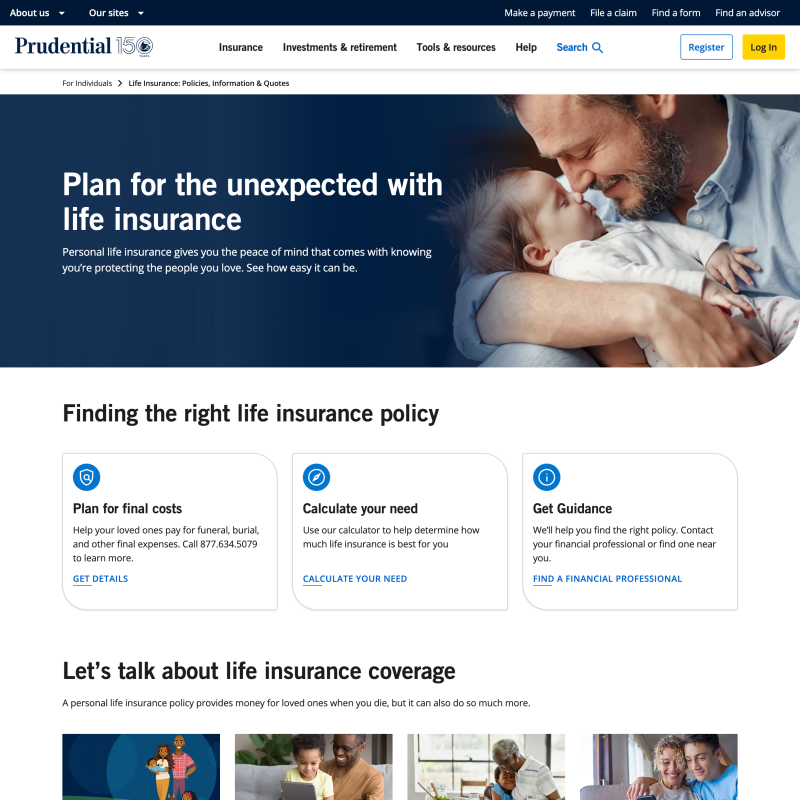

Prudential Financial

Prudential is one of the largest financial services institutions in the world. They offer a wide array of life insurance products, from basic term policies to more complex universal life plans with built-in investment components.

- Key Strength: Variety of policy types and robust financial tools.

- Ideal For: Consumers seeking flexible options, including investment-focused coverage.

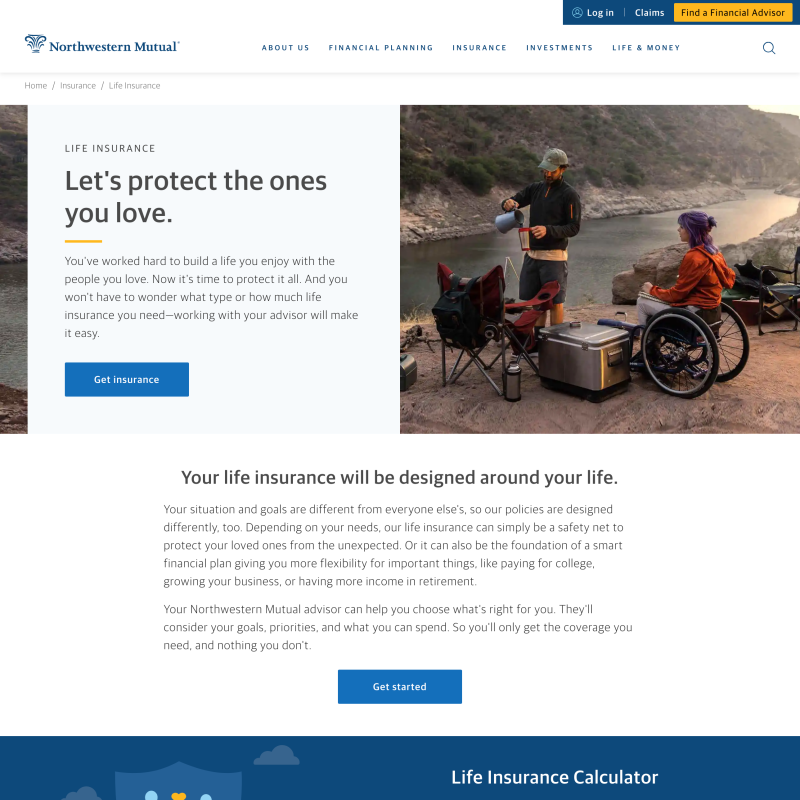

Northwestern Mutual

Renowned for its personalized approach, Northwestern Mutual provides life insurance alongside a suite of financial planning and investment services. Their agents are known for crafting tailor-made solutions.

- Key Strength: Personalized financial advice and strong track record.

- Ideal For: Individuals wanting a long-term relationship with a dedicated advisor.

Why You Need Life Insurance

Financial Security for Your Family

One of the main reasons people buy life insurance is to protect their families from financial hardship. If you were suddenly gone, would your loved ones be able to maintain their current standard of living? The death benefit from a life insurance policy can help replace lost income and pay for everyday necessities like food, utilities, and education.

Covering Debts, Mortgages, and Final Expenses

Life insurance can also help settle outstanding debts, including credit card balances, personal loans, and mortgage payments. Additionally, funeral costs and final medical bills can be significant, and the payout from a policy can relieve your family from having to shoulder those expenses alone.

Peace of Mind for Unforeseen Events

No one wants to imagine worst-case scenarios. But planning for the unexpected can bring peace of mind. Knowing that your spouse or children are financially safeguarded, no matter what happens, allows you to focus on living life to the fullest today.

How Life Insurance Works

Premiums, Policies, and Payouts

You pay a monthly, quarterly, or annual premium to keep your life insurance policy active. In return, the insurer promises to pay out a death benefit if you pass away while the policy is in force. The policy’s cost will depend on factors like your age, health, and lifestyle.

The Role of Beneficiaries

When you purchase life insurance, you’ll name one or more beneficiaries who will receive the payout. It’s wise to review and update this information over time—especially if you experience major life changes such as marriage, divorce, or the birth of a child.

Common Terms Explained

- Death Benefit: The lump sum paid out upon your passing.

- Cash Value: The savings component in permanent insurance policies (e.g., whole, universal, variable) that can accumulate over time.

- Riders: Optional add-ons to customize your policy, such as critical illness coverage or accidental death benefits.

How to Choose the Right Life Insurance Policy

Assess Your Needs

Before picking a policy, consider the financial needs of your family if you were no longer there to provide for them. Think about outstanding debts, ongoing living expenses, and future goals such as a child’s education.

Compare Policy Types and Features

- Term vs. Permanent: Decide if you need coverage for a specific period (e.g., mortgage term) or for a lifetime.

- Flexibility: Do you want the option to adjust your death benefit or premium payments as your needs change?

- Investment Component: Are you interested in growing a cash value or investing part of your premium?

Tips for Calculating Coverage Amounts

A common guideline is to have a death benefit that’s 10 to 12 times your annual income. However, factors like the number of dependents, total debts, and anticipated education costs should also influence your decision. You might also consult a financial advisor or use online calculators to refine your coverage estimate.

Common Myths About Life Insurance

“It’s Too Expensive.”

Many people overestimate the cost of life insurance. In reality, young and healthy individuals often lock in affordable monthly premiums—sometimes less than the cost of a streaming subscription. Even if you’re older or have health issues, it’s worth shopping around for the best rate.

“I Don’t Need It Because I’m Young.”

The best time to buy life insurance is often when you’re young and healthy, as premiums are typically lower. Waiting until you have a serious medical condition can lead to higher rates or even denial of coverage.

“My Employer-Provided Policy Is Enough.”

Relying solely on an employer-provided policy can be risky. Coverage might be insufficient or may end if you switch jobs. Owning a personal policy ensures continuous protection no matter where your career takes you.

A Closer Look at Costs

Factors Affecting Premiums

Several factors influence the cost of a life insurance policy, including:

| Factor | Description |

| Age | Younger applicants typically pay less. |

| Health | Chronic conditions, smoking status, and overall medical history matter. |

| Lifestyle | Occupation and hobbies (e.g., skydiving) can affect risk and premiums. |

| Policy Type | Term is generally cheaper than permanent coverage. |

Tips for Saving Money on Policies

- Shop Around: Compare quotes from multiple insurers.

- Maintain a Healthy Lifestyle: Quitting smoking or losing weight can lower premiums.

- Bundle Policies: Some companies offer discounts if you buy multiple types of insurance.

- Pay Annually: Paying your premium in one lump sum per year can save on administrative fees.

Sample Premium Ranges

- Term (20-year, $500,000 coverage): $20–$50 per month for a healthy individual in their 30s.

- Whole (Lifetime, $250,000 coverage): $100–$300 per month, influenced by age and health status.

Life Insurance for Different Life Stages

Young Professionals

Starting early can be a strategic move. Premiums will be lower, and you’ll have the flexibility to adjust coverage as your career and family goals evolve.

Parents with Young Children

Families benefit greatly from life insurance, as it can cover day-to-day expenses and future college tuition for children. If you have a mortgage or other debts, the death benefit can also alleviate financial burdens on your spouse.

Empty Nesters

Even after your children are grown, life insurance can help your partner maintain their lifestyle, cover retirement expenses, and manage any remaining debts.

Seniors

Seniors often use life insurance to cover final expenses or leave a financial legacy. Policies designed for older adults sometimes require minimal medical underwriting, making coverage more accessible.

FAQs About Life Insurance

-

How Much Coverage Do I Need?

A general rule is 10 to 12 times your annual income, but exact needs depend on your individual situation. Consider factors like your mortgage, outstanding debt, living expenses, and future financial goals. -

Can I Change My Policy Later?

Yes, you can often convert or adjust your coverage type (e.g., from term to whole), though this might involve additional underwriting or higher premiums. -

What Happens If I Miss a Premium Payment?

Missing one payment won’t always result in immediate cancellation. Many insurers offer a grace period. However, if payments remain overdue, your policy could lapse, ending your coverage.

Final Thoughts

Life insurance isn’t just a financial product; it’s a promise to those you love. Whether you’re a new parent, a young professional, or planning for retirement, the right policy can offer a layer of security when life is at its most uncertain.

Now that you have a clear grasp of the essentials of life insurance, take the next step. Assess your needs, compare reputable providers like BestMoney, MassMutual, and Gerber Life, or explore options with Prudential and Northwestern Mutual. A little research today can ensure a safer tomorrow for the people who matter most.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

I'm a single mom and I'm the sole provider for my kids. I've always been too scared to look into life insurance because I thought it would be too expensive. This article has helped me realize that it might be more affordable than I thought.

I've been thinking about getting a life insurance policy for a while now, but I'm not sure where to start. I saw a BestMoney review on a few different policies. Has anyone here used BestMoney to compare life insurance quotes?